Online payments

3 months free

special offer

Comgate payment gateway brings you real savings — up to 20% lower fees and more completed payments. Special offer - 3 months for free means even more savings. Are your fees for you payment gateway too high or are you struggling with too many declined payments? Change it now! View the special offer – 3 months free

Thousands of clients switch to us every year

They come for a fair price, they stay because of the service.

21k

e-shops

100+

payment methods

26

languages

9

currencies to pay with

Payment gateway with emphasis

on payment completion

The widest range of payment methods. Which ones will you activate? That's up to you.

A wider range of payment methods means a greater chance of payment completion by the buyer.

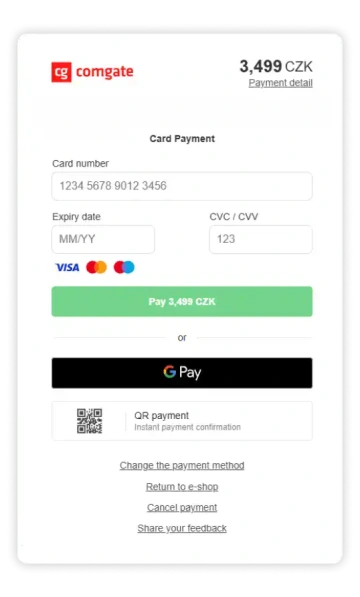

VISA, Mastercard, Google Pay, Apple Pay, PayPal are payment methods for all countries and all languages of the payment gateway.

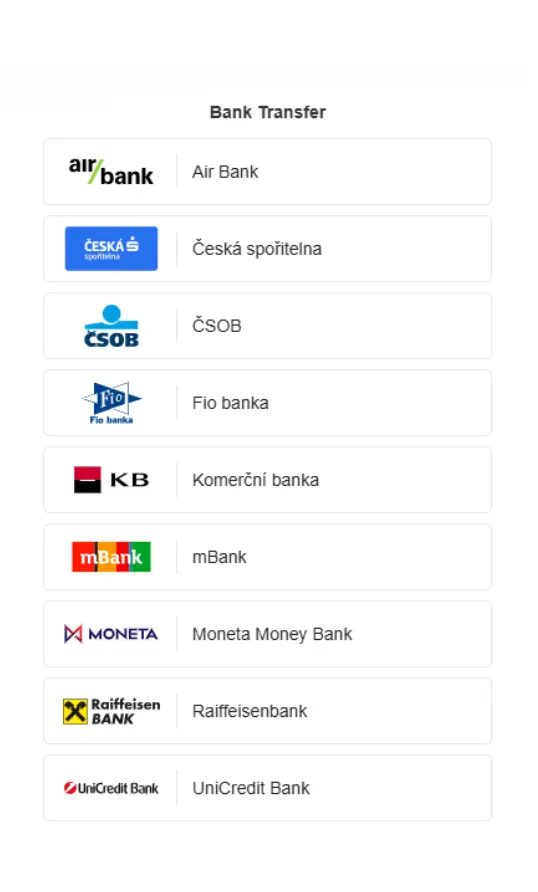

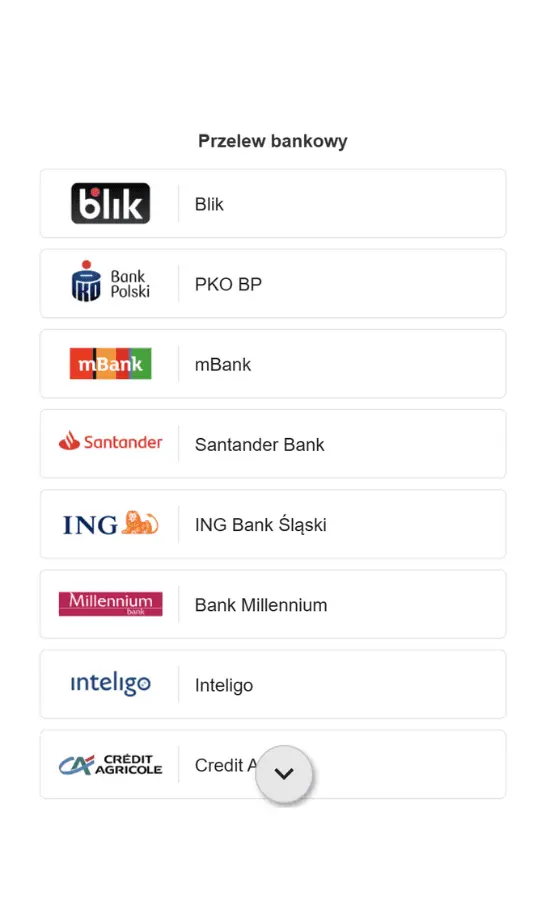

Bank transfers, especially with instant payment confirmation, are a popular alternative to credit cards in some countries.

The Comgate payment gateway has a full range of banks in Czechia, Slovakia and Poland.

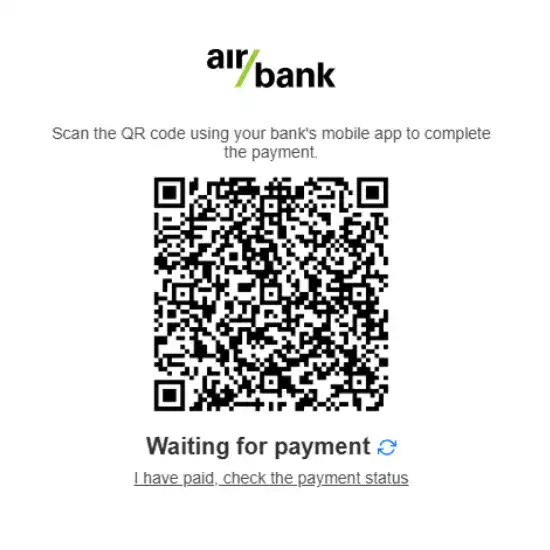

QR payment is very popular when paying on a computer. Some users also pay with a QR code on their phone.

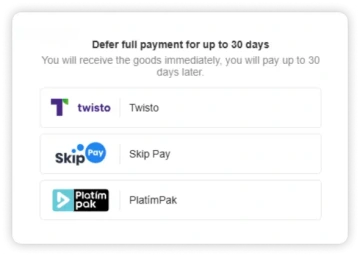

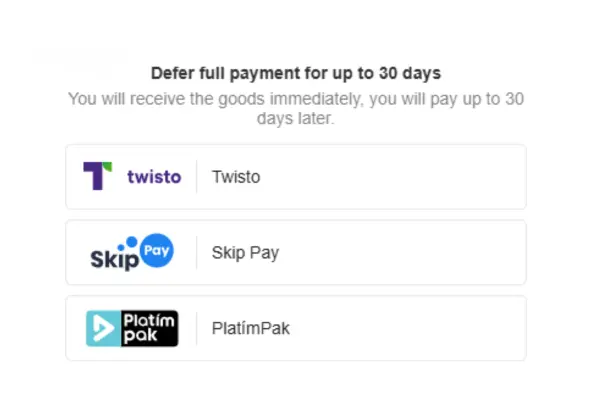

Deferred payment users will be among your customers. It's a good idea to offer them their preferred payment method.

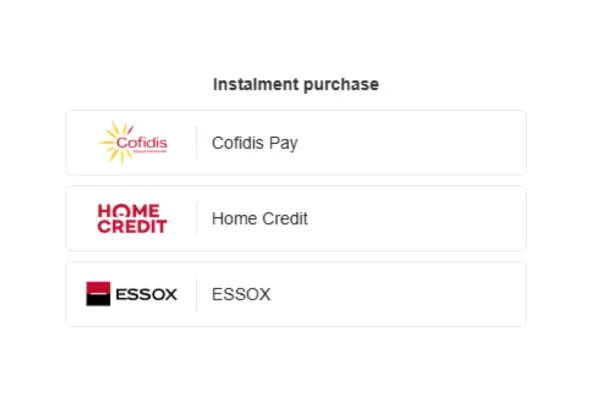

Do you sell high value goods and do not offer installment sale? We'll handle it for you, directly in the payment gateway.

Wondering what the payment gateway looks like?

Try it out

We offer four options for displaying the payment gateway in the e-shop:

REDIRECT – redirect to gateway URL

INLINE – nested window

INLINE – pop-up window

Checkout SDK – payment methods directly in the shopping cart

The appearance of the payment gateway can be customized to match the graphics of the e-shop. The gateway can contain your logo, the background of the gateway can contain your image or graphics.

Expanding?

You are at the right place

We can help you expand into foreign markets. Our payment gateway offers local payment methods in addition to card payments in 26 languages and 9 currencies.

An example is Blik, popular in Poland, or bank payment buttons in Slovakia and Czechia.

There are local standards for QR payments in different countries. We will make sure this method works for you in Czechia, Slovakia or Germany.

The payment gateway communicates in 26 languages. You can accept payments in nine currencies: CZK, EUR, PLN, HUF, USD, GBP, RON, NOK, SEK.

Pick your plan

Start

0 %

for merchants with their first card payments contract

Easy

1 %

Fee for 95% of the most common cards.

Profi

0.67 %

+ 1 CZK. Fee for 95% of the most common cards.

Custom

custom

fees

for monthly payments volume over 3 mil CZK

Pricing based on payment methods.

Promotions and guarantees

The “3 months free” promotion for the Easy and Profi plans applies to transaction fees for payments up to 500 000 CZK, regardless of the payment method, made within the first three months after the first transaction. The promotion does not apply to monthly fees for the payment gateway, terminal rental, or any other non-transaction fees. The benefit can be used up to the sixth month after signing the contract. This offer is intended for merchants who already accept card payments.

For the first six calendar months from signing the contract, card payment fees are free up to CZK 50,000 per month, as well as monthly fees for operating the payment gateway or terminal rental. From the seventh month, the Easy plan will be activated for the client. For card payments exceeding CZK 50,000 per month and for other payment methods, a flat fee of 1% + EUR 0 applies. The Start plan is part of the Czechia Pays by Card project, an initiative of the Ministry of Industry and Trade of the Czech Republic and the Visa and Mastercard payment schemes.

We guarantee that Comgate offers the best price for its services. By “best price,” we mean a price lower than the merchant’s current actual costs for a comparable payment service over a selected period. The comparison is based on the total costs across the client’s entire portfolio of merchant locations and includes all payment transactions.

To apply for the guarantee, please email us at obchod@comgate.cz. Attach your current price list and a statement of service fees for at least one month. Based on this information, we will contact you with an offer or clarifying questions. An exception to this guarantee applies if such an offer would violate applicable laws, e.g., competition regulations.

We guarantee that the fees listed in the above pricing plans will not change at least until 31 December 2026.

Save up to 20% on costs

Transfers to any bank

account are free

transfers to the client's account at a bank in Czechia or Slovakia are free

transfers are carried out every working day

we send payments in the currency in which the payment was made, so payments in CZK will be sent to your CZK bank account and payments in EUR will be sent as EUR to your EUR bank account

we do not perform currency conversions, so you save on fees

Payments from the e-shop that are credited to our bank account on the D-day are transferred to the customer's bank account no later than the next business day, and often on the same business day.

transfers to your bank account are free

payments will be sent to your existing bank account in Czechia or Slovakia, no need to change the bank

SEPA payments in EUR are also free within all EU, EEA and other European countries

Simple integration without coding

concluding the contract simply online, no need for a personal meeting or a visit to a bank branch

deploy the service in a matter of days

free payment gateway activation

operation with monthly payment volumes above 100 thousand CZK for free

termination of the contract at any time without charge

connection to more than 100 e-shop platforms

modules for open-source platforms

API for large e-shops

data exports in ABO, CSV and PDF

clear daily and monthly statements

automatic export to accounting

What our clients say

We can also provide customized solutions

we have three ways of payment gateway integration

we also offer full integration of payment fields into the shopping cart

For selected clients, we operate a solution where payments are sent to individual bank accounts according to a set key. This solution is suitable for e.g. insurance companies, state administration or hobby associations.

We will pass on some of the costs of paying with a business card or a card issued outside the EU to the buyer. The solution is suitable for merchants where shoppers often pay with a card other than a private payment card issued in the EU.

We run our services on our own information system. We are therefore highly flexible, we can go beyond standard solutions to develop a service customized to the needs of a specific client.

Security first

VISA and Mastercard

acquiring license

Comgate is a Principal member

of Visa and Mastercard card companies.

As a card acquirer we have unlimited access to all card technologies.

European payment

institution license

The institution license allows Comgate to offer payment services across the EU with no transaction volume limits while being regulated by the Czech National Bank.

PCI DSS Level 1

security certificate

The PCI DSS top-level certification is awarded to companies that demonstrate the required level of information systems security and is renewed annually.

Looking for more info?

Take a look at our support portal help.comgate.

Frequently Asked Questions

Which is the best payment gateway?

The best payment gateway is the one that provides the best conversion rate between initiated and completed payments, has the lowest fees, has high-quality customer service, ... read more

Which is the cheapest payment gateway?

When selecting the most cost-effective payment gateway, you should carefully consider the differences between the marketing communications regarding prices and the actual costs charged. Some of the most prevalent instances of unethical practices of payment gateway providers include the following ... read more

Which payment gateways operate in the Czech Republic?

Several well-known payment gateways operate in the Czech market, including Adyen, Comgate, GoPay, Global Payments (GPwebpay), PayU, Shoptet Pay, Stripe, and The Pay. We have outlined the key features of these providers in a separate article ... read more

Payment gateway comparison. Where can I find independent comparisons?

When comparing payment gateways, we recommend using independent comparator sources. This article gives some examples, such as Arecenze.cz Comparison of the best payment gateways 2025, 5Nej.cz Payment gateways comparison, ... read more

How expensive is an e-shop payment gateway?

The fees for payment gateways differ from provider to provider, not only in terms of the price but also in how it is calculated. There is a fundamental difference between fixed prices and MIF++ or Interchange++ ... read more

Please visit our Frequently Asked Questions page for more useful questions and answers.

Do you have any questions?

We are available online weekdays from 8:00 to 20:00. Your questions will be answered as fast as possible.